Watch the video below to learn about the latest economic updates.

Protect and grow wealth in uncertain times

Interest rate swings, market volatility and global tensions make one thing clear: wealth management needs both protection and growth strategies to thrive.

Finding the balance between driving growth and safeguarding capital takes a disciplined approach to portfolio construction but it could help your wealth to endure, despite the ups and downs of the market and the impact of inflation on your purchasing power.

Many investors equate balance with diversification alone. But balance means understanding how each investment or exposure contributes to the twin goals of growth and protection and whether the portfolio is robust enough to withstand challenging times.

There’s no one-size-fits-all answer. Depending on age and stage in life, some investors are chasing aggressive growth while others want capital preservation. The key is to ask:

- What am I earning and why? (High returns usually mean higher risk – are you comfortable with that?)

- How will the portfolio behave when it matters most? (Will it cushion losses or make them worse?)

- What investment decisions will I regret if inflation persists (for say, the next five years) or markets tank?

A US study of almost a century of data confirmed that portfolios handle downturns better and recover faster if they combine growth assets with true diversifiers, including a mix of low-correlated investments and defensive assets.i

Low-correlated investments are assets that don’t move in the same direction as equities, helping to reduce overall portfolio volatility. Their correlation to stocks is low or even negative. Examples include government bonds, gold, some hedge fund strategies and commodities.

Defensive assets are expected to hold their value or outperform during market downturns. They’re chosen for stability and capital protection. Examples include cash, high-quality bonds, defensive equities (such as utilities, healthcare) and infrastructure.

The ‘cost’ of growth

Growth typically comes from listed equities, private equity, venture capital, real assets and exposures to big, long-term trends that may cut across multiple sectors. For example, healthcare innovation, energy transition or AI.

The catch? Growth invariably means volatility. If the markets dive you could feel pressure to sell at the worst time.

Defensive equities may help provide some balance. They’re shares in companies that tend to provide stable earnings and dividends regardless of whether the economy is booming or in a recession. They have strong cash flow because they sell needs rather than wants, such as power, food and medicine, and they have the ability to raise prices to cover rising costs without losing customers.

While portfolio protection starts with bonds and cash, some would say they’re not enough today and a broader range of assets may be more beneficial.

Bonds, for example, have lost a little of their shine as the chief risk stabiliser after a crazy five years or so. The rollercoaster ride of historic low interest rates during the Covid era to the great reset from about May 2022 when the RBA’s (and the US Federal Reserve) rate hikes began. Both stocks and bonds crashed. Today, bond investors are enjoying a ‘rare sweet spot’ with yields well above the pandemic lows.ii

Because yields are higher, bonds now provide a significant income buffer. If bond prices fall slightly, the high interest payments can offset that loss. If rates stay the same or fall, investors lock in those higher yields.

Since most economists believe the hiking cycle is over or nearing the end, there is a chance that as central banks eventually cut rates, bond prices will rise, giving investors both high income and capital gains.

Other strategies

Other protective strategies may include buying bonds that mature at different intervals, such as every year for five years. Known as a bond ladder, this strategy means a portion of your money becomes available every year and it may provide some interest rate protection.

Physical investments, or real assets, such as real estate, infrastructure, commodities, natural resources and equipment can act as a hedge against inflation. When the cost-of-living increases, the value of physical assets tends to rise as well.

Alternatively, you could consider floating rate exposure or inflation-linked bonds (known as Treasury Indexed Bonds or TIBs in Australia and Treasury Inflation-Protected Securities or TIPS in the US).

Floating-rate bonds adjust interest payments as rates change, while TIBs increase principal and interest when inflation rises, providing a hedge against rising prices.

TIBs offer further protection with a built-in deflation floor that protects your original investment if prices fall.

Currency is the silent player

If you invest globally, currency matters. So, foreign exchange planning should be an intentional decision rather than a portfolio by-product.

The Australian dollar often falls when global markets panic so unhedged overseas assets can act as a shock absorber.iii

But full exposure can swing returns wildly. On the other hand, a partial hedging policy, for example, hedging some developed-market bond exposures, may balance volatility and opportunity.

Finally, protection is a liquidity plan. For families using trusts, SMSFs or investment companies, keep enough cash or short-term assets to cover 12–24 months of cash needs (tax, capital calls, distributions). That’s real protection.

Please give us a call to check your portfolio meets your current needs for growth and protection.

Portfolio protection in a nutshell

- Include defensive equities and quality bonds

- Diversify with low-correlation assets

- Consider inflation-linked bonds or floating rate exposure

- Maintain liquidity for 12-24 months of cash needs

i It Was the Worst of Times: Diversification During a Century of Drawdowns

ii A terrific environment for bonds | Vanguard Australia FAS

iii Drivers of the Australian Dollar Exchange Rate | Explainer | Education | RBA

Planning for the cost of education for your kids (or grandkids!)

It’s not realistic to put a dollar sign on the cost of your child’s or grandchild’s future. But calculating the cost of education can help you draw a close enough estimate particularly in relation to the type of schooling you want to be able to afford them.

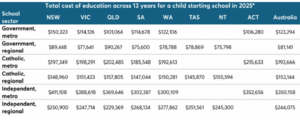

If you’re considering private school options, school fees are a major cost and have trended faster than the rate of inflation. Additionally, there’s uniforms, textbooks, extra-curricular activities and trips – that also need to be factored throughout the 13-year school journey. It’s also worth considering how the costs compare across school sectors if you are in two minds about school type.

Source: Futurity Investment Group Planning For Education Index 2025

It doesn’t stop there though. Post-secondary pathways could see your child or grandchild consider a slew of avenues ranging from University through to vocational training where course duration and costs vary depending on course type. Although the HECS-HELP study assistance loan is an option to delay payment of the core course fees, consideration to short-term study expenses such as textbooks and possible accommodation relocation requirements need to be given. There’s also the long-term impact HECS- HELP debt could have on your child or grandchild pursuing future goals and life events such as home ownership.

It sounds overwhelming and probably is, given that it might not be something that you’re even considering but planning and building a strategy to help you fund the costs and adequately cater for in your cashflow and budget.

Know your options

An obvious bit of advice is to do your due diligence and weigh up the benefits and downsides of various strategies.

Investing in a child’s name is generally not a sensible option – as any income (over $416) will be heavily taxed.

Another common strategy is to establish a share portfolio or savings account, with a parent acting ‘as trustee for’ their child. Interest/dividend income earned though is generally required to be declared in the name of the adult taxpayer, and when the time comes to accessing the investment for the educational purposes it was intended to serve, capital gains tax can represent a significant financial cost.

An often-over-looked option is the structure of an education bond. Designed to facilitate the entirety of an individual’s educational journey, education bonds can be contributed to by anyone and are taxed internally at the company tax rate of 30%.

Education Bonds: tax – effective product to fund education costs

A type of investment bond that if acquired through a friendly society or life insurer is classed as a ‘scholarship plan’ under Australian tax law. It enables the provider to receive a tax deduction for certain educational expenses, which the bond owner will receive in the form of a rebate when withdrawals are made to cover education costs.

Additionally, the capital invested is not locked in for educational purposes only. If circumstances change and other needs arise, funds are accessible for any purpose at any time, and control over how and where the money is invested is retained until it is withdrawn. Another feature is the estate planning benefits – the nature of the structure requires a beneficiary to be nominated, and in the event that the bond owner passes away, benefits can still be maintained via bond guardian.

Achieving peace of mind

Educational expenditure isn’t generally regarded as an activity that can be managed in a tax-effective manner, but it can be done and can allow you to re-allocate capital to other priorities is added bonus.

If you have any questions about how you can better prepare for the total cost of education, whether for your kids or grandkids, please get in touch.

5 Financial Traps Young Australian Professionals Should Avoid

Starting your career with a healthy salary is exciting, but many young Australian professionals stumble into preventable financial traps that can delay their long-term goals by years. Here are five common pitfalls to be aware of.

Buy-Now-Pay-Later debt spirals

Services like Afterpay and Zip make spending feel painless, but multiple Buy Now Pay Later (BNPL) commitments can quickly spiral out of control. What starts as “just four easy payments” becomes a juggling act of overlapping debts that eat into every pay. Unlike credit cards, BNPL isn’t always captured in credit reporting, making it easy to lose track of how much you truly owe. Before you know it, you’re living pay to pay despite earning well.

The new car money pit

Few financial decisions destroy wealth faster than buying an expensive new car early in your career. A $50,000 vehicle depreciates $10,000 the moment you drive it off the lot, plus you’re paying interest, insurance, registration, and fuel. That same money invested in your super or an index fund over 10 years could grow to $80,000 or more. Evaluate whether you even need a car, given your work and lifestyle circumstances, and consider a reliable used car instead.

Over-committing to property too soon

The pressure to “get into the market” leads many young professionals to stretch themselves dangerously thin. Borrowing at maximum capacity leaves no buffer for interest rate rises, repairs, or life changes. Being house-poor in your twenties means sacrificing experiences, career mobility, and investment diversification. Take time to build a solid deposit and ensure the property aligns with your lifestyle, not just FOMO.

Lifestyle creep with every pay rise

Each promotion brings a bigger pay, but also a nicer apartment, better car, and overseas holidays. Before long, you’re earning double your starting salary but saving the same amount or less. Combat lifestyle creep by automatically increasing your super contributions and investments with each pay rise, locking in savings before you can spend them.

Following social media financial “gurus”

Instagram and TikTok are filled with self-proclaimed experts promoting day trading, crypto schemes, and property “secrets.” These influencers often earn more from course sales than their actual investment strategies. Real wealth-building is boring: consistent super contributions, diversified index funds, and patient compound growth. If someone’s selling a financial shortcut, they’re probably profiting from you, not with you.

Avoiding these traps won’t make you rich overnight, but it will set you years ahead of your peers.

Why Financial Advice matters, especially approaching retirement

Australia’s retirement landscape is changing. According to the Australian Bureau of Statistics, by 2032, there will be more Australians over 65 than under 18, marking a significant demographic shift. While we’ve built a world-class superannuation system worth over $4.1 trillion[1], many retirees still struggle with a crucial question: how do I turn my savings into confidence?

The gap between saving and spending

The Superannuation Guarantee is now 12%, meaning retirees who have recently left the workforce are wealthier than any previous generation, but the transition to retirement often brings anxiety rather than excitement. According to Challenger’s recent Retirement Happiness Index, two in five Australians aged over 60 rank running out of money as one of their top retirement concerns, second only to maintaining good physical health.

The confidence gap: Advised vs Unadvised

The difference professional financial advice makes is striking.

Unadvised Australians are twice as likely to be extremely or very worried about outliving their retirement savings compared to those who have sought advice, 35% versus 19%[2]. The research also shows that Australians with professional financial advice report higher happiness levels (73.9%) compared to those without (64.4%).

The benefits of advice extend beyond financial peace of mind:

- Mental wellbeing: 82% of advised Australians report good mental health, compared to 72% of those without advice.

- Knowledge confidence: 72% of advised retirees feel confident about their retirement financial knowledge, versus just 46% of the unadvised.

Pre-Retirees need support

Those approaching retirement face unique anxieties. Pre-retirees are significantly more worried about financial issues than current retirees:

- 46% worry about not having enough money to do what they want (compared to 34% of retirees)

- 44% fear running out of money in retirement (compared to 33% of retirees)

This is where financial advice proves most valuable, in navigating the critical transition from accumulation to drawing down their savings with confidence.

What retirees really want

The research is clear: Australians crave income certainty. With 78% aged over 60 saying they’d be happier with a guaranteed income for life. This isn’t just wishful thinking; it’s driving real behaviour. Recent CoreData research shows that product adoption has surged 150% since 2023.

Your Retirement, Your Confidence

Retirement should be a time of opportunity, not anxiety. While building wealth is important, converting that wealth into a reliable income and genuine confidence requires guidance and planning.

Professional financial advice isn’t just about managing money. It’s about creating the certainty and confidence you need to truly enjoy the retirement you’ve worked so hard to achieve.

We can help build a plan that turns your superannuation into the retirement lifestyle you envision, with the peace of mind that comes from knowing your money will last.

The information contained in this article is general information only. It is not intended to be a recommendation, offer, advice or invitation to purchase, sell or otherwise deal in securities or other investments. Before making any decision in respect to a financial product, you should seek advice from an appropriately qualified professional. We believe that the information contained in this document is accurate. However, we are not specifically licensed to provide tax or legal advice and any information that may relate to you should be confirmed with your tax or legal adviser.

[1] https://www.apra.gov.au/news-and-publications/apra-releases-superannuation-statistics-for-march-2025

[2] https://www.challenger.com.au/individual/Campaigns/Happiness-Index